START AND SCALE YOUR OWN SUCCESSFUL VIRTUAL

TAX OFFICE EMPIRE

Unlock the blueprint for launching and growing a thriving tax business from scratch. Our all-in-one program equips you with the strategies and resources to succeed in the ever-changing tax industry. Master client acquisition, financial management, and the delivery of top-tier tax services. Build the skills and confidence needed to run a profitable firm and achieve lasting financial freedom.

OUR PACKAGES

SOLO PACKAGE

TAX SOFTWARE

Gain access to our industry-leading tax preparation software designed to streamline and simplify your entire tax filing process. This powerful tool equips you with the professional-grade technology used by top tax experts, helping you manage client returns efficiently, reduce errors, and save time. Whether you're just starting out or looking to upgrade your current system, this software-only package gives you everything you need to confidently handle tax preparation at a professional level—without the extra costs of unnecessary add-ons.

PRO PACKAGE

TAX SOFTWARE & TAX ACADEMY PACKAGE

Get everything you need to run a successful and professional tax business with our Tax Software + Tax School package. This all-in-one solution includes our industry-leading tax preparation software plus access to our comprehensive Tax School training program. Whether you're building a team or sharpening your own skills, this package ensures that you and your staff are fully equipped to handle client returns with accuracy, confidence, and compliance. From mastering tax law basics to learning efficient software workflows, the included training empowers your team to deliver top-tier service while reducing costly errors and increasing productivity. Plus, in the Pro Plan, you’ll enjoy unlimited students—meaning you can add sub-offices and preparers to the school for free. It’s the perfect blend of powerful tools and practical education to help you grow and scale your tax business with ease.

GROW PACKAGE

ALL INCLUSIVE PACKAGE

Take your tax business to the next level with our All-Inclusive Package. This comprehensive bundle includes everything you need to launch, manage, and grow a professional and profitable tax practice. You’ll receive our powerful, industry-leading tax software, in-depth training through our Tax School, and direct access to expert guidance with office hours and one-on-one support during tax season—ensuring you’re never alone when it matters most. You’ll also unlock exclusive bonuses, including proven marketing templates, volume pricing discounts, and high-value resources designed to help you attract more clients and boost your revenue. Plus, in the Grow Plan, you’ll enjoy unlimited students—meaning you can add sub-offices and preparers to the school for free. To make it seamless, we’ll provide a simple enrollment form so you can register those preparers with ease. And to help you build your dream team, we’ll recruit, hire, and train a Virtual Assistant who will support your tax business—freeing you up to focus on growth and client service. Whether you're a solo preparer or building a team, this package delivers the tools, training, support, and staffing you need to thrive in the tax industry.

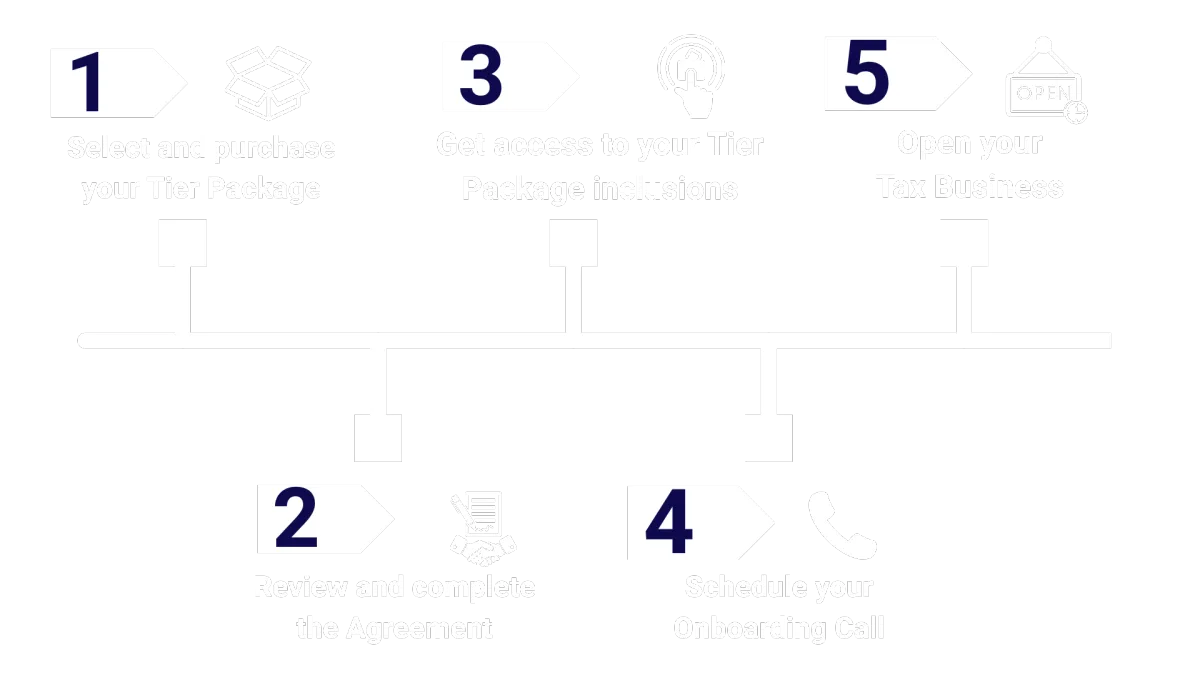

START YOUR

TAX BUSINESS TODAY!

There's never been a better time to take control of your future and launch your own tax business. Whether you're looking to create a new income stream, gain more flexibility in your schedule, or build a legacy of financial independence, the tax industry offers incredible opportunities. With the right tools, guidance, and support, you can start serving clients, growing your brand, and making a real impact in your community. Don’t wait for the perfect moment—create it. Start your tax business today and take the first step toward success on your own terms!

HEAR IT FIRST-HAND FROM THE CEO & FOUNDER

LaBena Oatis-Curtis, EA

"HOW TO SAVE 5-7 FIGURES FROM TAXES"

LaBena Oatis-Curtis is a knowledgeable and committed tax professional, enrolled agent, and tax strategist who specializes in guiding individuals and small business owners through the often-confusing world of taxes. As an Enrolled Agent (EA)—the highest credential awarded by the IRS for tax professionals authorized to represent taxpayers—LaBena has earned the privilege to represent clients directly before the IRS in audits, collections, and appeals.

With extensive experience in both tax planning and resolution, she is driven by a mission to inform and uplift her community—sharing practical strategies that help taxpayers reduce their liabilities and maintain IRS compliance.

Recognized as a reliable source of guidance, LaBena is passionate about making tax education accessible to all, regardless of income or background. She has supported numerous clients in identifying valuable deductions, avoiding costly errors, and gaining clarity and confidence in their financial decisions. Her goal is to simplify the tax process and remove the intimidation factor for everyday earners.

Whether she's providing personalized tax advice or creating informative content, LaBena is dedicated to helping others succeed. Her philosophy is clear: empower people to keep more of their income while staying fully compliant with tax laws.